It hasn’t been smooth sailing for the Capstone spacecraft as it attempts to reach the moon. The microwave-size probe is an advance emissary for NASA‘s Artemis program, but it’s just encountered a new technical snafu.

NASA says that Capstone entered safe mode on Sept. 8 after attempting a trajectory correction maneuver. “The mission operations team is in contact with the spacecraft and working towards a solution with support from the Deep Space Network,” NASA said in a statement on Saturday. The Deep Space Network is how Capstone communicates with its handlers back on Earth.

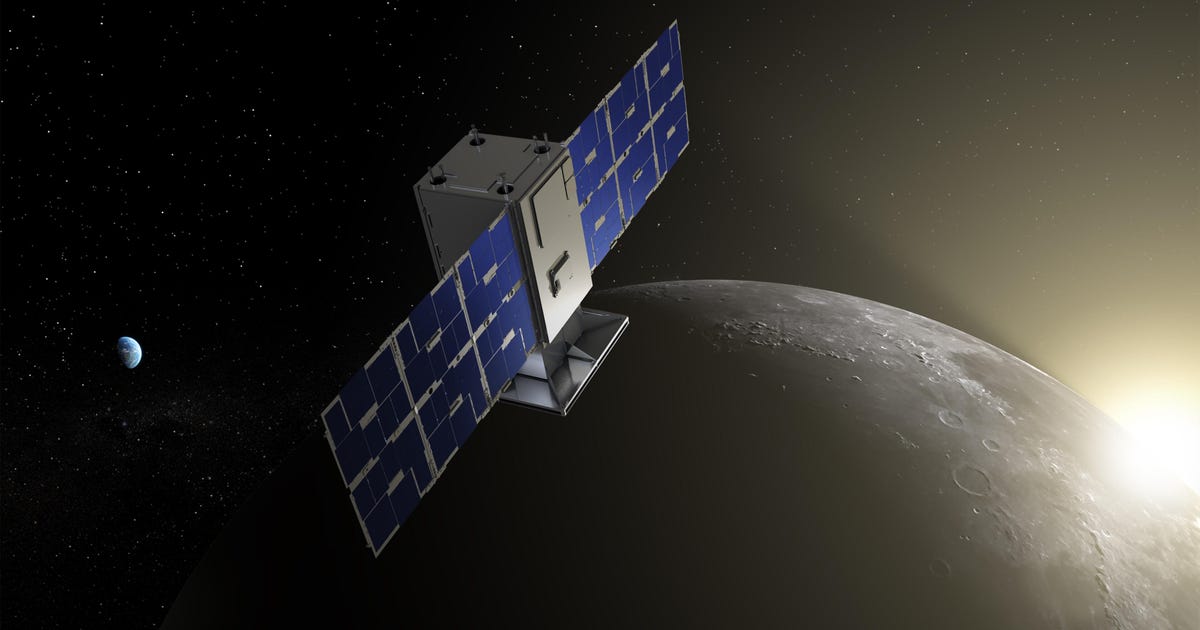

Capstone — which stands for Cislunar Autonomous Positioning System Technology Operations and Navigation Experiment — is heading to the moon to test a new kind of “halo” orbit, one that NASA hopes to use for its future Gateway, a small moon station designed to host human visitors.

Artemis and Apollo: How NASA’s SLS Moon Rocket Stacks Up to Saturn V

Colorado-based Advanced Space operates the spacecraft. “We have since obtained telemetry that confirms the vehicle suffered an anomaly near the end of the planned maneuver and is currently in safe mode,” Advanced Space said in a statement. Safe mode is an action a spacecraft takes to protect itself, often by shutting down nonessential functions. Your personal computer may experience a similar state of being when you’re tracking down a technical problem.

Capstone is still in touch with its operations team. In July, Capstone lost contact for a day, a brief but worrisome period of time. The communications issue was resolved, and it seemed Capstone was good to go, but the new anomaly means the team will have to go into troubleshooting mode once again.

Capstone launched in late June to kick off a four-month journey to the moon. NASA will provide updates on the spacecraft’s status when more information is available. Until then, it’s a bit of mystery as to what’s bugging Capstone this time.