This story is part of Gift Guide, our year-round collection of the best gift ideas.

Grandparent’s Day is this Sunday, Sept 11. While it might not have all the panache of Mother’s or even Father’s Day, these time-tested pillars of the fam deserve some big props, too. I mean, who else is going to sneak you out for ice cream when Dad says no?

Many grandparents put in hours of work helping raise grandkids, shuttling them to practice and telling bedtime stories. Plus, bubbe and pepaw are always voted least likely to forget your birthday, and Grandparent’s Day is a perfect time to throw some of that love and appreciation right back at ’em.

A letter, card or phone call always goes a long way. But if you’re looking to really spoil gram and gramps this year, we’ve rounded up 11 solid gifts for grandparents that they’re sure to love (especially since it’s coming from you.)

Best gifts for grandparents in 2022.

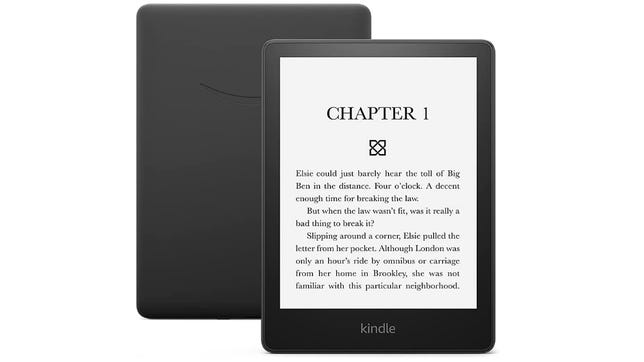

Amazon

Amazon’s all-new Paperwhite is a worthwhile upgrade for the grandparent who likes reading e-books. This version features a larger 6.8-inch display and an adjustable warm light. The regular version has 8GB of storage while the Signature Edition boasts 32GB ($190) — plenty of space for favorite book titles.

Harry & David

If there’s one gift that’s almost universally failproof, it’s snacks and Harry & David have the gift basket thing figured out. This charming collection of eats includes everything listed below, all for $70.

- Moose Munch popcorn –

- Double chocolate chunk cookie

- Walnut chocolate chunk cookie

- Thuringer sausage

- Hickory-smoked summer sausage

- Dry salami

- Sharp white cheddar cheese

- Mesa Verde snack mix

- Mixed nuts [cashews, almonds, walnuts, pecans]

- Honey hot mustard

- Pepper and onion relish

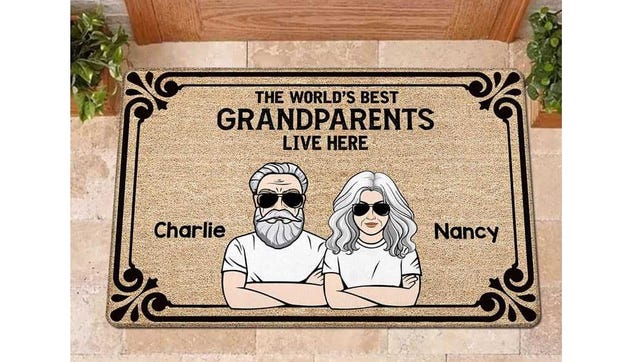

Trending Custom

Create a custom doormat featuring the World’s Best Grandparents — yours! This is a fun gift that’s sure to bring a smile to grandparents who appreciate holiday humor. Opt for one grandparent or two, choose how they look, and even add names on this 24×16-inch mat. You can preview before purchasing to ensure that it’s perfect. This personalized gift is a great Christmas gift for your grandparents during this holiday season.

Demdaco

If ever there were a perfectly comforting shawl, this is it. Demdaco’s Giving Shawl is generously sized, seriously soft and cozy — Grandma will love having two deep pockets for anything she needs to keep on hand. Bonus: The Giving Shawl comes boxed with a ribbon for gifting and includes a bookmark with a touching message. It’s available in sage, pink, taupe and cream.

Amazon

Puzzle and game brand Ravensburger’s Cozy line is a huge hit with the grandparents. The 500 large-format pieces are optimal for older adults because they’re easier to see and handle. And check out the soothing winter scene: a roaring fire, fluffy pets and a steaming cup of tea. Grandma can really get swept up in the Cozy Retreat puzzle during and after the holidays!

Amazon

This set of lamps is such a sweet gift: Keep one, give the other to grandparents and whenever you touch your lamp, the other one glows too to let your loved ones know you’re reaching out. The lamps set up easily using your home Wi-Fi, and more can be added — so you could potentially set up a family lamp network. You can also customize these lamps with over 200 color options.

Shutterfly

Shutterfly has lots of affordable photo book options, including a new collaboration with home organizer Marie Kondo. We love the Moments of Joy photo book for compiling family memories. Customize one for the grandparents and choose your size, cover type, page type and more. Pricing varies depending on the design you choose.

Zodiac

Who doesn’t love unwrapping a cozy pair of slippers in December? Treat the grandparents to a pair of Zodiac’s chic Paloma slippers, a slip-on suede number lined with faux shearling. Available in black, blush, cognac and multiplaid, this pair has a sturdy sole for the occasional outdoor stroll.

Uncommon Goods

This beautiful cloth-bound journal contains prompts designed to get the recipient writing. Grandparents can document interesting anecdotes, wisdom and tidbits of information that will be valuable to pass on. My Life Story — So Far has 106 pages and comes with 36 photo corners for adding pictures to the journal. Over 450 five-star reviews tell you that this is a quality gift.

Nixplay

Send family photos and videos (up to 15 seconds) straight to this 10.1-inch digital frame. It’s a great way for grandparents to view all the latest grandkid exploits. Use the Nixplay app to control the frame, which can connect to Google Photos, Dropbox, Instagram and Facebook. A motion sensor starts the slideshow, and the frame can also be connected to Amazon Alexa. Just don’t forget to set it up in case tech support isn’t in Grandma’s wheelhouse.

Personalization Mall

Grandma or Grandpa can serve their favorite dishes with pride in this personalized ceramic dish. The hand-glazed stoneware piece (available in red or turquoise) measures 14 x 10 x 2.75 inches and one line of text can be added.

Find The Perfect Gift

AllUnder $10Under $20Under $50Under $100Under $250

allmomsdadsgrandparentsfitnesstravelersteenspreteenstechgamingfoodiesromanticjewelryhomekids

107 results